Announcement

FINAL | BUSINESS CASE - BCS 06

Finance Manager Submission BCS 06

NMO 2020

Financial plan and budget allocation for the expansion of Ramalingam foods

Submission Date & Time : 2020-04-26 02:05:11

Submitted By: Naseef nazar Nalakath - Finance Manager From Team Sky

Assignment Taken

Finance Department: Develop and propose a financial plan with allocated budget for International expansion.Case Understanding

ABOUT THE COMPANY: Ramalingam Foods started as a fast food restaurant in 1965. It was famous for its authentic fresh South Indian bakes and filtered coffees. With a need to innovate during the emergency in 1975, the company came up with Dosa-idli batter and readymade chutneys. It became a popular choice due to the ease of use and portability. Later in the 90s, with the aim to expand the business, the company launched ready-mix sort of powdered Dosa idli batter and readymade chutneys. This was an instant hit and boosted the growth of the company. The company noticed that some people purchasing their Instant mixes domestically (In India) and selling it in foreign countries. Apart from families and individuals, there was a demand for these mixes in restaurants too in these countries. Seeing a scope for growth, the company hired our company for consultancy for expansion into international markets. PROBLEMS RELATED TO FINANCE DEPARTMENT Since the company is entering into new territory, there are more chances of unexpected costs. The company is not familiar with various expenses that can arise during the operations and hence it is necessary to prepare a thorough and detailed budget. Even in the same region, the cost can vary from country to country depending on legal requirements like testing and approval, tax rules, other regulations, supply chain characteristics specific to the country, etc. Hence a conservative budget with sufficient scope for flexibility becomes essential Cultural and language differences are important for expansion. We will need to do market research to get a local person's perspective (cultural taste), hire a translator, a lawyer, etc. These are deciding factors for choosing the region of expansion. Packaging and safety standards need to be looked at specifically country wise. The food labels and instructions of use ought to be printed in the local language, increasing cost. Other packaging standards defined by the country's food authority body will also be important. If these things are not looked in specifically, it can cause a delay. Some countries also have lots of paperwork that's necessary for entering the market. All this requires time and appropriate fund allocation.BCS Solution Summary

With the 50-crore set aside for expansion, the company aims to strongly penetrate the market covering all essential aspects. By exporting from Indian factories to the 5 south Asian countries (Singapore, Myanmar, Indonesia, Thailand, Malaysia), the company aims to generate a revenue of 30 crores for the first year (from international markets). The highest expense is Cost of manufacturing (10.5 crores) followed by marketing and salary. An operating income of 6.3 crores and net income of 1.8 crores is projected from the 30-crore revenue. A feasible allocation of the 50-crore assigned by Ramalingam Foods for expansion is determined. In the allocation, factory and land is the major investment followed by working capital. In the next year, factories will be setup abroad to boost sales and reduce cost of export.Solution

Sales & Revenue

The company has a target of 30 crores revenue for the first year from all the 5 countries combined. This has been decided based on 2 things: the current production capacity of the factories in India and a 5-7% of penetration in overseas markets (the 5 countries). The sales target increases from 28k units /month (April FY ‘18-19) to 3.2 lakhs units /month (March FY ‘19-20). This is a 25% increase each month. Such growth can be expected since we are entering an FMCG market where the customer base is largely untapped. Our primary target category will be the Indian population living in these countries. The revenue from foreign markets will be much higher once the factories abroad are set up. This will be because of the cheaper labour and lower transportation costs.

The prices of the already existing products have been kept the same, roughly because of the similar standards of living of these countries with India. The export costs are not extremely high and hence there is no need to increase the mark-up of the existing products. There are also 2 new products that will be introduced in each of the 5 countries. The prices of these items will be a bit higher than the existing products:

- 200 grams- Rs. 111

- 500 grams- Rs. 249

- 1000 grams Rs. 486

|

Product Categories |

Name |

Weight |

Price |

|

1 |

North Indian dishes Instant Mix |

200 Gms |

89 |

|

2 |

North Indian dishes Instant Mix |

500 Gms |

199 |

|

3 |

North Indian dishes Instant Mix |

1000 Gms |

389 |

|

4 |

Desert Mixes |

200 Gms |

110 |

|

5 |

Desert Mixes |

500 Gms |

249 |

|

6 |

Desert Mixes |

1000 Gms |

499 |

|

7 |

Chutney Powder |

200 Gms |

75 |

|

8 |

Chutney Powder |

500 Gms |

199 |

|

9 |

Chutney Powder |

1000 Gms |

329 |

|

10 |

South Indian Instant Mix |

200 Gms |

89 |

|

11 |

South Indian Instant Mix |

500 Gms |

199 |

|

12 |

South Indian Instant Mix |

1000 Gms |

389 |

|

13 |

Instant Coffee Mix |

200 Gms |

149 |

|

14 |

Country Specific 1 |

200 Gms |

111 |

|

15 |

Country Specific 1 |

500 Gms |

249 |

|

16 |

Country Specific 1 |

1000 Gms |

486 |

|

17 |

Country Specific 2 |

200 Gms |

111 |

|

18 |

Country Specific 3 |

500 Gms |

249 |

|

19 |

Country Specific 4 |

1000 Gms |

486 |

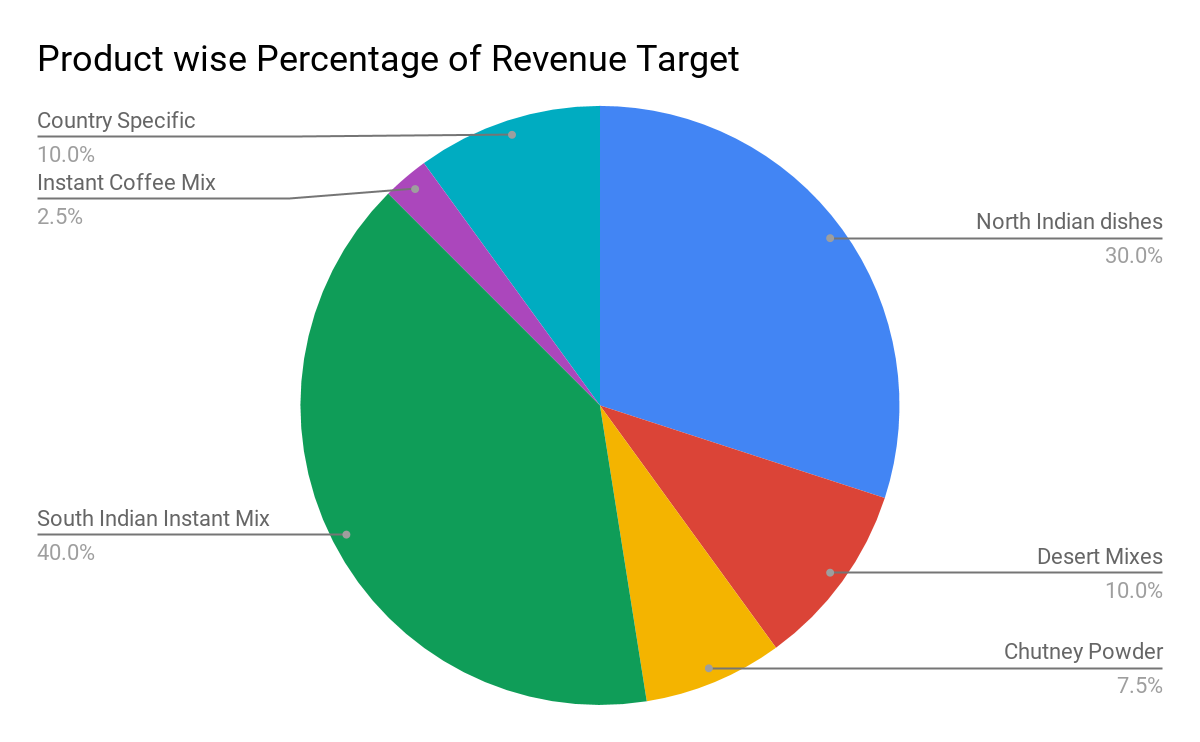

Revenue from product type as a percentage of total revenue:

We expect to promote the existing product line and 90% of the revenue comes from those products and 10% from the newly launched country-specific products. Out of the existing products, south Indian dishes will contribute about 40% and north Indian mix has a 30% contribution. The details are given in the table below

|

Product Type |

Revenue Percentage |

|

North Indian dishes Instant Mix |

30% |

|

Desert Mixes |

10% |

|

Chutney Powder |

7.5% |

|

South Indian Instant Mix |

40% |

|

Instant Coffee Mix |

2.5% |

|

Country-Specific |

10% |

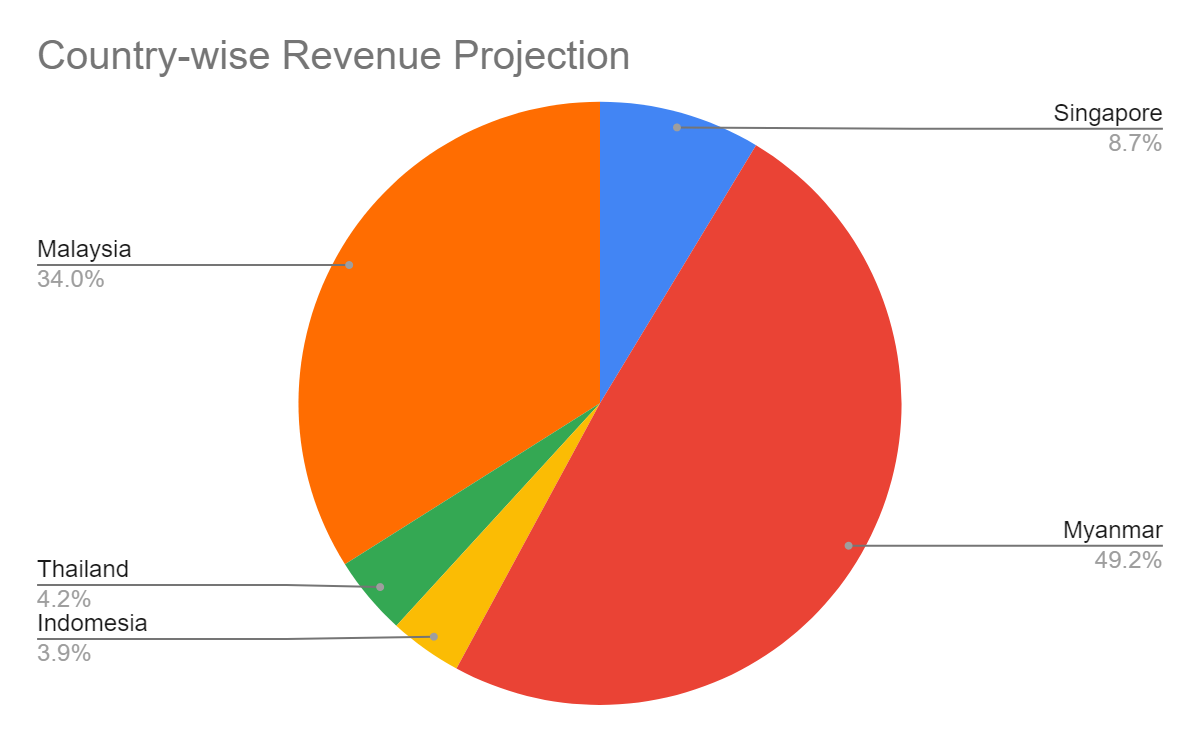

Country-wise split of Revenue Estimate

The 5 chosen countries for expansion differ on factors such as the size of customer target and standards of living. For example, Singapore has been named as one of the world's most expensive by The Economist Intelligence Unit report in 2019. Malaysia and Indonesia are rated as the cheapest cities according to Big Mac Index, 2019 (Big Mac index is a measure of purchasing power parity- comparing countries based on cost of living). The total revenue estimate from each of the 5 countries is decided based on the population of Indians.

|

Country |

Population of Indians |

Country-wise projected Revenue |

Revenue compared to total revenue |

|

Singapore |

5.1 |

2.59762309 |

8.658743633 |

|

Myanmar |

29 |

14.77079796 |

49.23599321 |

|

Indonesia |

2.3 |

1.17147708 |

3.904923599 |

|

Thailand |

2.5 |

1.273344652 |

4.244482173 |

|

Malaysia |

20 |

10.18675722 |

33.95585739 |

|

Total |

58.9 |

30 |

100 |

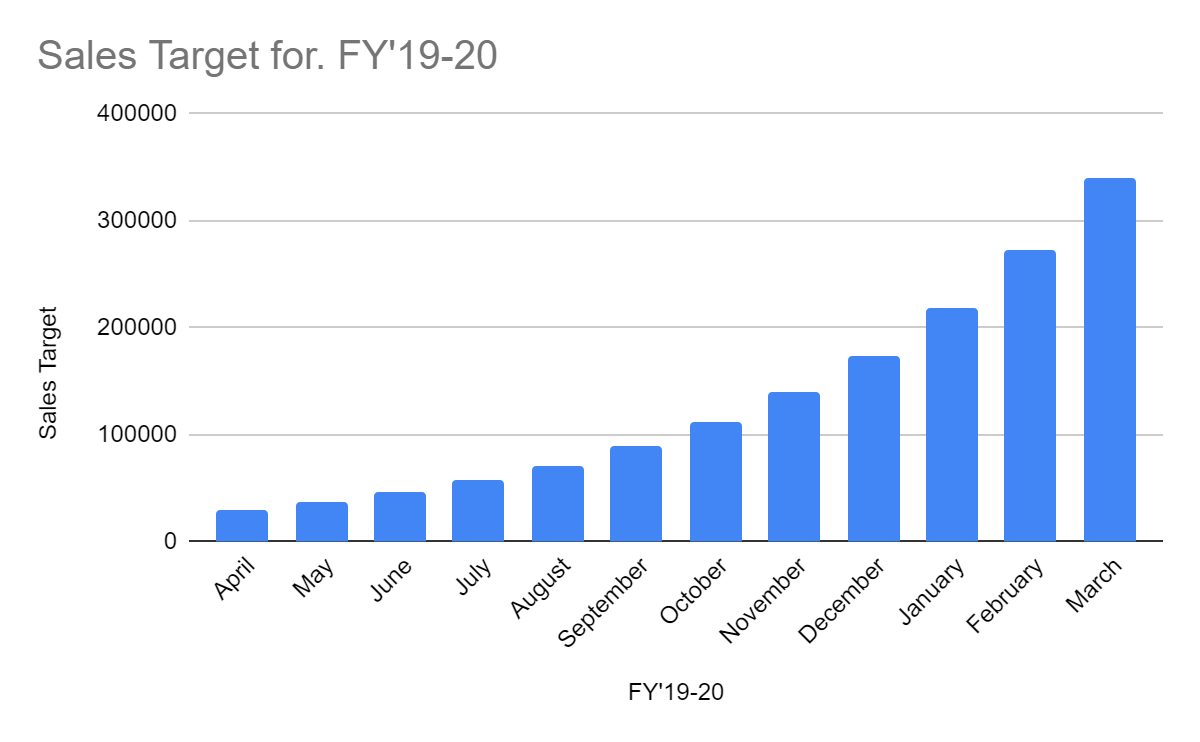

Sales Target for FY'19-20

From the above revenue projections, a sales target (quantity) has been made. Here the main assumption is that 200 grams, 500 grams and 1000 grams are sold in the ratio of 2:2:1. This assumption is based on the notion that people tend to buy smaller packets more. The sales targets are made using size of target consumers in each country. A 25% monthly growth has been projected based on a 5-7% penetration in the markets.

|

FY'19-20 |

Sales Target |

|

April |

29224 |

|

May |

36530 |

|

June |

45662 |

|

July |

57078 |

|

August |

71347 |

|

September |

89184 |

|

October |

111480 |

|

November |

139350 |

|

December |

174187 |

|

January |

217734 |

|

February |

272168 |

|

March |

340210 |

|

Total |

1584153 |

Note: A 25% of Month-to-month growth is projected, considering the market size and penetration rate. Complete calculations can be found in the attachments.

Running Expenses

Cost of manufacturing

This cost comprises of cost of raw materials and the regular maintenance of the machineries in factories. The production in current factories will be ramped up (assuming the factory utilization can be increased) and more quantities produced for export. Hence this cost can be estimated accurately as the company has the past data of production. The increase in employees and machineries in each factory can help to achieve better economies of scale. This increased production in current factories will also help to capture the market while new factory in foreign country will be setup in 1 year. Hence, by the time factories are functional after a year, there will be large demand in international markets. So, going for exports in the first year and then having factories in foreign countries is a feasible choice.

HR - Salaries

There are 5 employees in each corporate office located in each of the 5 cities. The head of the office will have a salary of 70K per month while the others are given 60k per month. This amount has been fixed by taking into consideration the cost of living in these countries. The salaries have been decided taking into consideration the Purchasing power Parities (PPP) of the countries. Malaysia, Thailand, Indonesia Singapore and Indonesia have PPPs roughly close to that of India’s. This means that the cost of living is almost the same in these countries compared to India and hence the salaries seem appropriate. However, Singapore is an exception and hence the employees over there will have a higher pay. To produce and export goods, the factories in India require more manpower. Hence 40 employees (assuming the current factory’s capacity utilisation can be increased) is hired as labourers in Indian factories.

Note: calculations henceforth are also done in rupees itself, due to roughly equivalent PPPs as well as to maintain uniformity and ease of calculations. The Currency conversions can be used to derive country specific budgets based on the Conversion units to the country's national currency.

Marketing and Advertising Expenses

The marketing will contain a mix of both traditional and digital marketing strategies. Since the brand name will be new to the target customers, the spending for marketing and advertising is expected to be on the higher side. Even a 5% penetration in the market requires a good budget since the company is a new entrant in the international market. With a target of roughly 30 crores revenue, the marketing, advertising and promotion is given a budget of 4.5 crores (15% of revenue). The traditional marketing will mostly involve TV Advertising, Out of home advertisements such as billboards, and newspapers. The digital means involve Social media, website designs and video advertising. Note that TV ads are costly and hence will have a major share of the marketing expense. The marketing has a sufficient budget of 4.5 crores (roughly 15% of revenue) allotted. This is essential since the company is entering into a new market where there are some international competitors such as MTR and local competitors too.

Export and operation expenses

The export and transport cost will be paid to the export agent and distributors. Since the company is not having factory production for the first year, they do not require a full-time logistics team. If needed, we can hire workers on hourly basis in the foreign countries. This will be cheaper compared to having a full time dedicated logistics and operations team. Another advantage of local suppliers is the strong supply chain they have established in the food industry in these countries. The waterways are a very cost-efficient method that minimizes the transport cost. The company’s export partners and distributors in foreign countries reduce the burden on the manpower required. Roughly 5% of revenue or 1.5 crores is allotted for this expense

Legal Costs- Licenses and Tax

There are various one-time costs for permissions such as;

- IEC Import-export code,

- FSSAI License,

- NOC Certificate,

- RCMC (Registration cum membership certificate)

Permission for corporate offices and trade in the 5 countries also include approval from;

- Singapore-accounting and corporate regulatory authority (ACRA)

- Malaysia-Suruhanjaya Syarikat Malaysia (SSM)

- Thailand Ministry of commerce

- Directorate of Investment and Company Administration (DICA)

- Indonesia Investment Coordinating Board

The countries also have a GST of 6-8% which includes cost, insurance and freight (CIF) plus other chargeable costs. Note that the FTAs that India has signed with ASEAN countries have reduced the excise taxes and customs duty. And hence GST tax will be the main expense paid towards foreign government

For the taxes to Indian government, all income whether from domestic or foreign sales is taxed at a corporate tax rate of 22% (since the total operating revenue is less than 250 crores- 150 from domestic sales and 30 from foreign sales). This effectively makes a tax of 25.17% including cess and surcharges (for manufacturing companies in India) on the operating profit.

Other Expenses

IT Front

Investment on IT is essential since data management and IT solutions have proven to be game changers in cost optimisation. Being a large company with expansion to 5 different countries, big data analytics and latest IT software/systems are prioritised. The table below shows the expenses for IT Department.

|

Department |

Name of Software |

Total Price |

|

Business Expansion and Marketing |

AI based servers (Microsoft Azure) |

1,26,380 |

|

Hadoop |

8,52,000 |

|

|

Mobile App and Website Designing |

10,00,000 |

|

|

Cloud based ERP |

2,62,487 |

|

|

Finance Department |

Financial Management Software |

11,36,000 |

|

HR |

HR Cloud |

1,01,672 |

|

Business Advisory |

Cloud Based Transport Management System |

1,50,000 |

Rent and other HR Costs:

The 5 corporate office will have monthly rent payments which are converted into rupees using the currency exchange rates. As done for wages, Singapore is taken to have a higher rental charge. Sufficient funds based on average rent for working space is used to allocate budget. Hr costs for hiring and incentives also have an amount of 20 lakhs kept aside.

Miscellaneous and Overheads:

A 5% overhead and miscellaneous expense on revenue is accounted for since the company is expanding into new markets and there are uncertainties in expenses. Besides, a manufacturing plant can have other expenses and supply chain intricacies may also add to the miscellaneous costs.

Expenses Summarised

|

Expense Category |

Amount Estimate (in crores) |

|

Cost of manufacturing |

10.5 |

|

Marketing |

4.5 |

|

Salary |

3.8 |

|

Rent |

0.4 |

|

Other HR Costs |

0.2 |

|

Exports and operations expenses |

1.5 |

|

Tax |

4.5 |

|

Miscellaneous & Overheads |

1.5 |

|

IT |

0.3 |

|

Permissions and Licenses |

1.0 |

|

Total |

28.2 |

Operating and net Income

An operating income (operating Revenue of 30 crores - operating cost of 23.7) or EBITA (Earnings Before Interest, tax and amortization) of 6.3 Crores is projected. The net income (operating income - tax of 4.5 crores) of 1.8 crores is estimated. Note that these figures are derived by taking costs on the higher side (Conservatism principle of accounting). The profit is expected to go up considering that factories will be setup in these countries and economies of scale can be achieved in the coming years.

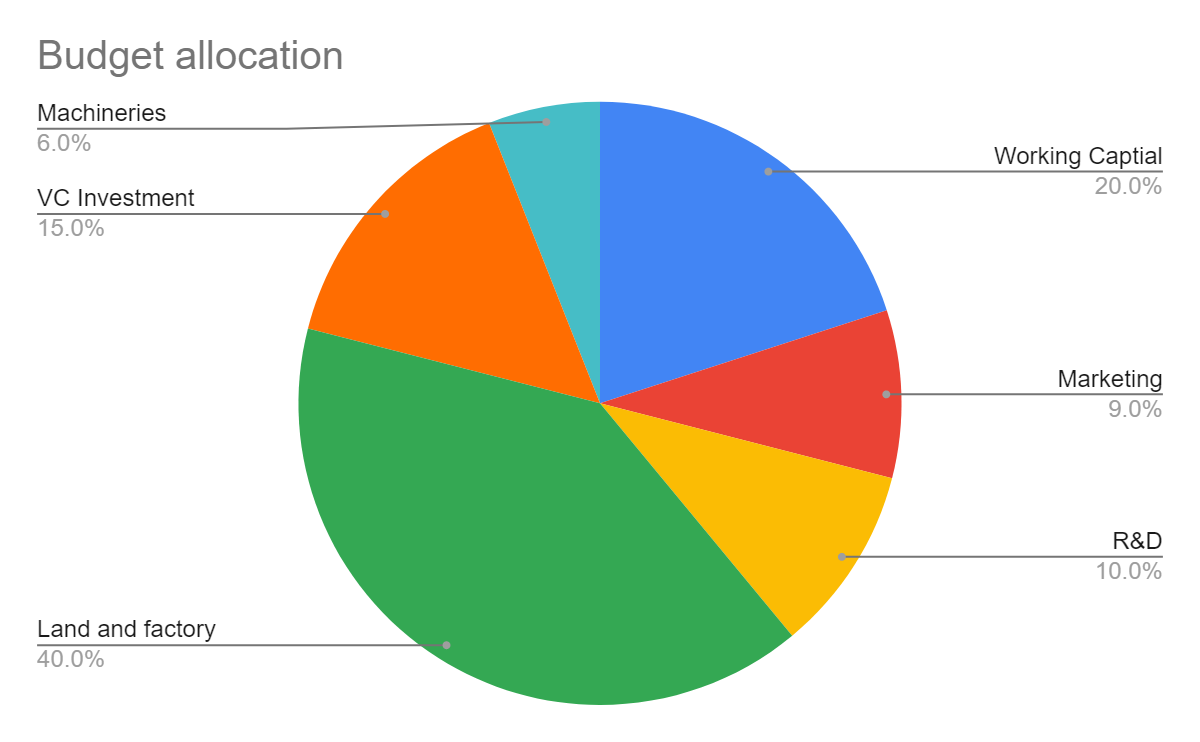

50 crores Budget allotment

|

Investment |

Budget allocation (in crores) |

|

Working Capital |

10 |

|

Marketing |

4.5 |

|

R&D |

5 |

|

Land and factory |

20 |

|

VC Investment |

7.5 |

|

Machinery |

3 |

|

Total |

50 |

The above allotment has been made by taking various factors into consideration:

- The working capital (10 crores- approx. 30% of the gross revenue of 30 crores from foreign market) is necessary to maintain the liquidity and boost the export operations for first year.

- Land and factory- the biggest investment of 20 crores- is for the purpose of setting up 3 factories (approx. cost of one factory and its machinery is 6.6 crores) in these countries.

- Marketing has a budget of 4.5 crores (15% of 30 crore gross revenue from international market), to boost the company’s visibility in foreign countries and use numerous means of advertisements.

- The machineries have a budget of 2.5 crore- to ramp up current production in Indian factories for export by installing machines and increasing factory utilization.

- Venture capital investment or start-up fund of 7.5 crores is meant for investing in in food-related companies in the south Asian countries. The start-up fund will help the company to strengthen its presence in the foreign country and expand with more products aligned with local taste of the country.

- Lastly, a 5-crore investment in R&D can help to develop new products and remain competitive at all times. An R&D team can be constituted with industry scientists, engineers and market analysts.

Conclusion

Certain assumptions have been made in the above calculations that have been stated alongside. With a comprehensive account of expected revenue and costs, the expansion process for Ramalingam Foods can become smoother. The budget allocation of 50 crores has been done considering all the essential aspects of growth in such an industry.Attached File Details

Budget are allocated in the right way, good work

Participant

Naseef nazar Nalakath

IIM INDORE

Naseef Nazar is an MBA student in Indian Institute of Management Indore (IIMI).

He has cleared Chartered Financial Analyst (CFA) Level One in first attempt.

He is also certified in NISM Investment Advisor Level 1 with a score of 81.5% and NISM Research Analyst with a score of 92.5%.

He is passionate about banking and finance.

Well aware of the market trends, he is an active learner and dedicated student.

Team Sky BCS 06 Submission

Total Team Points: 63004.5

Team Air BCS 06 Submission

Total Team Points: 66715.5