Announcement

FINAL | BUSINESS CASE - BCS 06

Leader Submission BCS 06

NMO 2020

International Market Expansion Plan of Ramalingam Foods debriefed by Nexus Solutions

Submission Date & Time : 2020-04-25 14:24:25

Submitted By: Rahul Choudhury - Leader From Team Sky

Assignment Taken

Develop an International Market expansion planCase Understanding

A successful fast food restaurant, Ramalingam Foods, set up in Bombay was famous for its authentic fresh South Indian bakes and filtered coffees. During the emergency period, they found out another way of diversifying their business portfolio – they started selling authentic Dosa-idli batter and readymade chutneys and made decent margins. Now, when the son of Mr Venkatesh Ramalingam took over charge in the 90s, he wanted to expand the business. With the low self-life and perishability of wet idli batters, he made some innovations and prepared a ready-mix sort of powdered Dosa idli batter, which became an instant hit as it took care of the perishability issue. When the management noticed that some people are buying the mixes and exporting them to foreign countries, they started to ponder over the possibilities of taking the brand to the next level. So, they hired our company for consultancy regarding expansion in international emerging markets.BCS Solution Summary

A successful international expansion plan for expansion can be targeting the emerging markets of South-East Asia where the concentration of Indian people is higher. So, by doing analysis of the packaged food industry in countries in South East Asia, it was found out that Thailand, Singapore, Malaysia, Indonesia and Myanmar are the potential countries where the company can expand in the first phase. • For the initial phase of expansion, since we have 50 crores allotted for international expansion, the plan is to initially expand through partnerships and strategic alliances • The main competitors of Ramalingam Foods in these countries are Mavalli Tiffin Foods (MTR), an Indian counterpart which is a subsidiary of Orkla ASA, A Norwegian conglomerate covering a wide part of the globe encompassing the Nordics, Eastern Europe, Asia and Europe, Indofoods Sukses Makmur in Indonesia. • Currently Ramalingam Foods have a limited variety of mixes and SKUs – North Indian Mixes, South Indian mixes, Chutney Powder, dessert mixes and instant coffee mixes. The proposed plan is to expand in selected South East Asian markets with the existing SKUs and introduce a few products on the basis • Printing the instructions in the packets in native languages as well helps to reach a wider consumer base and attracts local consumers as wellSolution

Reasons behind targeting South East Asia

The key reason behind the possible business expansion plans are majorly as follows:

- Ease of Trade: There are free trade agreements signed with the South East Indian countries.

- Easy of Supply Chain and Transportation facilities: Costs related to supply chain and transportation is lesser, as the planned expansion is majorly focussed on the basis of a franchise model.

- Higher presence of Indian population in SEA countries: The Indian population in these countries is an important factor behind as well. The population stats for the targeted countries are:

Myanmar: 29 lakhs (5.3%)

Singapore: 5.1 lakh (9.1%)

Indonesia: 2.3 lakh (0.1%)

Thailand: 2.5 lakh (0.5%)

Malaysia: 20 lakhs (7%)

Proposed Expansion in Myanmar

In case of Myanmar, the population is growing and this provides a sizeable market for venturing into the country with the highest Indian population among the five countries zeroed upon.

- Increase in daily wage: A 33% increase in daily wage in 2018 implied that the country’s minimum daily wage stood at $4.80, or approx. Rs 300-350 - this is the perfect zone for the company to launch its products as they are priced at a reasonable rate.

- Availability of logistics: Most imported products arrive by sea through Yangon Port (around 60% of the total imports). The development of logistics hubs in Thilawa Port, and Dawei Port are already under process and this will smoothen the supply chain and logistics issues to a great extent.

- Demand for processed food products: There have already been a demand for British processed foods. Moreover, local F&B processing brands are absent. So, this clearly indicates that people are receptive to the processed foods industry and entry into the market won’t be that difficult.

- Government regulations: With increased importance to FDI, Government have specified regarding its stance on the overseas imports. Free trade agreements with ASEAN countries is a plus which will help to lower the tax burden.

- India’s Act East policy: India's exports to Myanmar increased at a CAGR of 17.9 per cent to US$ 1.2 billion in 2018 and is expected to rise higher in the upcoming years with relaxed trade regulations.

Product Mix for Expansion

Ramalingam Foods can enter into the Burmese markets with an enhanced mix of SKUs consisting both of the Indian and Burmese cuisine. In terms of Indian cuisine, it can enter with the already available products whereas in Burmese front, it can introduce

- Readymade Mohinga: A famous rice noodles served with a fish-based soup. For transportation and enhancing shelf life, the rice noodles and the powdered fish mix can be packed together.

- Burmese Indian Dosa batter: Alongside its Indian variant, the Burmese dosa batter is famous in the country. So, the presence of the Burmese variant of the Indian Dosa enhances the local connect.

Mode of Expansion

Ramalingam Foods expects to enter into partnership with local Burmese distribution giants, Pahtama Group. With an already established logistics base and strong supply chain network, Ramalingam Foods can minimize SC & Logistics related costs. With over 1000 employees, Pahtama Group is a common name in the Myanmar households.

Proposed Expansion in Singapore

Singapore is globally acclaimed for its irresistible passion for foods. Singaporeans spend approx. $7.7 billion on F&B. So, entering the Singaporean markets is of immense importance if the company wants to pace up its revenue growth.

- High Imports: Singapore exports nearly 90% of the food it consumes. So, this provides a brilliant scope for the packaged food imports to dominate the Singaporean markets.

- Increase in household monthly income: Household monthly income have been on the steady rise for quite a long time

- Busy schedules: The busy schedules have forced people to resort to the ready meals. So, people in Singapore are more receptive to the way they see the ready meals and the processed foods that save their time.

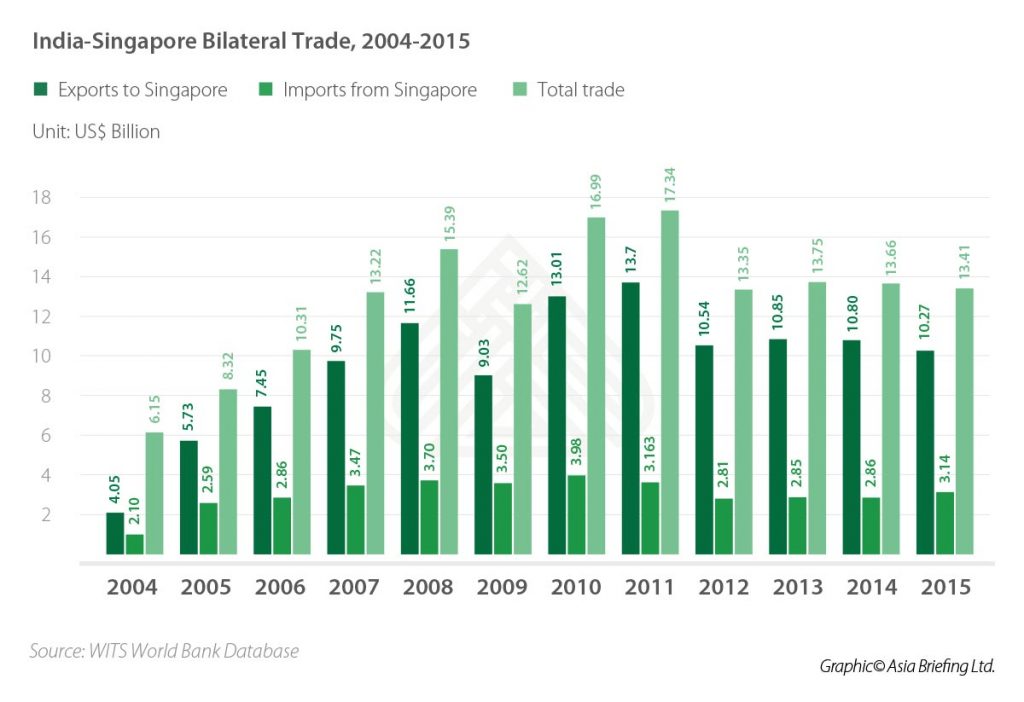

- India Singapore Trade relations: Singapore is India’s 2nd most preferred trade partners among the ASEAN countries in terms of revenue, accounting for 38% of its total trade with the ASEAN counterparts.

In FY 2018-19, the bilateral trade went past the 20 million USD barrier. With signing of Comprehensive Economic Cooperation Agreement (CECA) and further tariff cuts, the market seems to be even more booming than ever.

Product Mix for Expansion

With the highest percentage of Indian population among the SEA countries, it can be undoubtedly claimed that all the variants can be safely launched in the Singaporean markets. For the local flavour, two variants with limited SKUs can be launched initially as a part of pilot phase of the expansion.

- Satay: The ready-made grilled meat is quite popular in Singapore. The prepared fillets can be easily transported from Indian shores and have a high shelf life.

- Bak Chor Mee (Noodles with minced meat): Another famous delicacy of Singapore, it is essentially belonging to the non-vegetarian noodles category which also have high market potential and can be a high revenue grosser.

Mode of Expansion

Ramalingam Foods expects to form strategic alliances with Hosen Group Ltd (Hock Seng Foods) who are specialized for distribution of packaged foods. With a rich knit supply chain network across the globe, Hosen Group have a wide consumer reach which can be leveraged by the Ramalingam Foods.

Proposed Expansion in Indonesia

Convenience for the customers: With busy consumers and increase in single-person households, the processed food markets can leverage on this certain consumer inclination.

Openness to newer variants: Indonesian people are open to newer flavours and variants. So, launching a new food product won’t be a big deal if the firm can focus on health consciousness and hygiene aspects.

Product Mix for Expansion

Except the coffee mix (since Indonesia is the fourth largest producer of coffee, so launching coffee mix won’t generate sufficient revenue for the firm), the other variants can be launched in their respective 200 gms, 500 gms and 1000 gms variants. Other than that, local mixes can also be :

Sop Kambing: A popular soup consisting of celery, tomato and meat, a powdered mix consisting of the ingredients can be of huge popularity in the local Indonesian household during the winters.

Sambal :The chilli-based sauce is quite popular in Indonesia and can be an instant hit.

Mode of Expansion

In Indonesia, Ramalingam Foods will form partnerships with Tigaraksa Satria, the largest nationwide independent distributors. With a nationwide coverage, the expansion becomes easier to be put into effect.

Proposed Expansion in Thailand

There has been a steady increase in the consumption of processed and ready-mix foods in Thailand due to busier consumer lifestyles. So, there’s a huge untapped market that has a high growth potential.

Product Mix for Expansion

- Pad Thai (Instant Noodles): Stir fried rice noodles dish that is quite common in Thailand, it has a high market potential specially to attract the Thai locals in absence of major local food processing brands.

- Instant Massaman Curry Powder: Predominantly used for preparation of Thai chicken recipe in the Thai households, it’s an essential ingredient for the households as well.

Mode of Expansion

The firm plans to partner with Geeta Group distributors (Thailand) which specializes in transportation of processed consumable foods to restaurants all across the country as well the retail supermarkets. So, the firm can leverage from the wide consumer base of the parent company in the country.

Proposed Expansion in Malaysia

The main products which are being produced by the Malaysian food processing industry chiefly include beverages, canned seafood, dairy products, noodles and bakery products. High trade deficits in food sector In Malaysia have forced the government to make investments in the food sector. So, this provides a golden opportunity for Ramalingam Foods to enter the Malaysian markets as the domestic market is yet to be developed. So, there’s high untapped potential for expansion.

Product Mix for Expansion

All the current 13 products are expected to be launched in Malaysia. Apart from these, 2 local products are also planned for launch in a limited quantity for a pilot project to gauge consumer preferences.

- Nasi Lemak Mix (Rice of Coconut Milk): One of the famous items of Malaysia (possibly the national dish of Malaysia), it is a staple consume for the many Malaysian households.

- Roti Channai (Instant Mix): As per reviews, this mix is also quite popular among the people in Malaysia and hence launching mixes of the product can have a positive impact on branding and revenue generation as well.

Mode of Expansion

In Malaysia, Ramalingam Foods wants tie up with the iconic H.L. Young Group who have been a leader in the F&B sector in Singapore, Malaysia, existing over 50 years and specialises in dry food distribution network.

Getting hold of the IEC Code :Crucial for Hassle-Free Export

Ramalingam Foods should also fill up and get hold of the Import and Export Code (IEC) license for easy and hassle-free tracking and management of shipments in the foreign countries.

Moreover, once the firm gets hold of the IEC code, there is no requirement of annual renewals. The firm can do any number of transactions overseas once it has a unique IEC Code.

Organizational Structure

Since, the firm is expected to expand through partnerships and strategic alliances mostly, so the firm is expected to have one corporate head in each of the 5 proposed countries. The organization is expected to follow a functional organization structure since there is no plans for setting up manufacturing units in the countries initially. The corporate head is expected to oversee the functional and operational efficiency.

IT Infrastructure

The firm is expected to implement a Hadoop network to keep the data distribution management as its cheap and cloud based in India head office south Bombay. So, the overseas data can be efficiently tracked from the central server.

Further Expansion Plans

If the expansion plans go as planned and the projected revenues generated from the respective countries are as per Ramalingam Foods’ plan, the company can go for further aggressive expansion.Moreover, in the near future, the firm can think of setting up overseas manufacturing units to reduce the supply chain and logistics costs once Ramalingam Foods have gained a major market share in the overseas markets.

Road Ahead

- Increase in produce mix: Besides the existing 13 items in the product lines, product line can be extended to cereal mix, breakfast mix, ready-to-eat curries, snack mixes, spices and masala in a phase wise manner.

- Aggressive expansion in Middle East and UK: The firm is suggested to go for a relatively conservative expansion model while expanding in South East Asia to gauge the market value. Once it realizes its true market potential outside India, it can go for aggressive expansion in the remaining two zones where there is a high proportion of Indians present viz UAE (27%) and England (2.3%)

Conclusion

Ramalingam Foods initially plans to enter into South East Asia after judging all pros and cons and hence, choose 5 South East Asian countries like Myanmar, Singapore, Indonesia, Thailand and Malaysia where there is a significant presence of Indian population. Moreover, as per thorough market analysis, these are the countries constituting of local people who are highly receptive to cuisine from other countries as well. Post that,the firm can go on for aggressive expansion in the remaining two zones viz. Middle East and UK with an enhanced variety of product mix and SKUs for achieving more global market share in the long run.Attached File Details

Great work Rahul , explanation in southeast Asia is good. And this is well manage explanation of expansion plan

Participant

Rahul Choudhury

Indian Institute of Management Kashipur

Curious,diligent,adaptable,empathetic and teamplayer.Being a student at MBA at Indian Institute of Management,Kashipur as part of the 2019-2021 batch.Being a keenly motivated individual, my chief interest lies in Business development,strategizing & helping businesses grow.Looking forward to be a part of the everchanging industry dynamics & give back to the society.Besides this, I have also been recognized as one of the Top 10 College Champions Competitive Business Leaders,India \\\\\\\'20 by Dare2Compete, in association with CRISIL & CNBC-TV18.

Team Sky BCS 06 Submission

Total Team Points: 63004.5

Team Air BCS 06 Submission

Total Team Points: 66715.5