Announcement

FINAL | BUSINESS CASE - BCS 06

Business Adviser 2 Submission BCS 06

NMO 2020

Shipping methods and INCOTERMS for Ramalingam foods.

Submission Date & Time : 2020-04-26 02:01:35

Submitted By: Chinmay Bhavke - Business Adviser 2 From Team Sky

Assignment Taken

Define shipping method & International commercial terms (INCOTERMs) also advise which will be best in the interest of Ramalingam foods.Case Understanding

1. Ramalingam food has no experience in foreign markets. 2. Budget for international expansion is limited 3. Since the product is not a light weight product, the cost for shipping would be on higher side which needs to be minimized. 4. Packing and packaging of the product must be kept in mind when shipping abroad, it must protect the product and also deliver required information effectively. 5. There are many varieties of products in the portfolio of the Ramalingam foods, which will require accurate demand forecasting while shipping the perfect quantity of each products. 6. Since the company does not have required licence and permission, it needs to get it as soon as possible.BCS Solution Summary

The main solution includes the details regarding modes of transport, supply chain, documents & license required to export goods, packaging, export strategy, estimated cost of shipping and exporting, & INCOTERMS. It also provides detail information with explanation about how, where, whom, who, why, will deliver the products to the final consumers. Solution is aimed to provide Ramalingam Foods with every details and suggestions required for exporting their goods to Southeast Asia.Solution

Our consultant company name is NEXUS, which means connection between two things, and we here at NEXUS connect you to your solutions of your problems.

Our advice to Ramalingam foods is to expand their market in southeast Asian countries with the above-mentioned Brand name and logo.

List of countries to expand with number of Indians in the country

Singapore: 5.1 lakh (9.1% Indians)

Myanmar: 29 lakhs (5.3% Indians)

Indonesia: 2.3 lakh (0.1% Indians)

Thailand: 2.5 lakh (0.5% Indians)

Malaysia: 20 lakhs (7% Indians)

The reason for selecting this area for expansion are as follows

FTA: free trade association with these countries under ASEAN. This will lead to lower duties and taxes and also ease of trade between these countries.

Large Indian population: there are huge number on Indian origin people residing in these countries which make these countries a large market for Ramalingam foods.

Export through water ways possible: water way is available for export purpose as it is the cheapest option available in the export industry. Also, there are no limitation on the quantity to be exported and huge quantity can be exported in a go.

Tourism: as southeast Asia is famous for its nature tourism, many tourists from European, American, middle east countries can be targeted to sell their products. This will also help to form a base to entry in those market by making them aware of these products.

Shortage of fund: since company have only 50 Cr. Budget for international expansion, it is feasible for them to expand in geographically closer market with minimum trade restrictions, and as these countries are members of ASEAN, the trade restrictions are minimum, and in food industry its almost negligible. This will be a safe and sound strategy for Ramalingam food to enter international markets.

Due to above reasons, it is advised to Ramalingam foods to expand in Southeast Asian markets.

Shipping Details:

Mode of transport:

Ramalingam is advised to use Fishy Back technique to export goods.

In this technique the company will first use road transport to take the goods from manufacturing point to dockyard. From there, ship or vessel will be used to take the goods overseas market. Then once product reached the destination port, again road transport will be used to deliver the products to retailers.

Ocean Freight Shipping: ocean freight method is suggested as the mode of transport to expand in northeast Asian countries. The main reason is the low cost of transport. Since the product is not a perishable product, ocean transport can be used. Various other reason to choose ocean transport are as follows.

- Feasibility due to short distance: southeast Asian countries are closer to India and export through ocean is possible as average distance of all countries is approx. 1500 nautical miles (2778 Km approx.) from Chennai port. Shipping large quantity over such miles takes approx. 1-2 weeks maximum.

- Low cost: When compared to air transport, ocean freight is 80% cheaper in terms of cost and also provides more flexibility it terms of quantity to be shipped. A $195 ocean shipment can cost $1000 by air.

- Better Carbon footprint: compared to Air freight, ocean transport emits much lesser carbon into environment. This is important because when it comes to environment, sustainability is must. In my view, environmental effect should be one of the must components that should be included while taking any business decision. Therefore, ocean transport is better than air transport.

- Safety of goods: water ways are one of the safest means of transport available. Using water ways can reduce the risk of damage of goods.

These are the major reason to choose over ocean transport.

Following is the detail information on the distance between different countries and time take to deliver the shipment.

Distance of various ports from Chennai port (in Nautical miles) with number of days taken for shipping.

Yangon port (Myanmar): 1145 nm (5 days @ 10 knot speed)

Singapore port (Singapore): 1891 nm (8 days @ 10 knot speed)

Arun terminal (Indonesia): 1339 nm (5.6 days @ 10 knots speed)

Kantang harbour (Thailand): 1477 nm (7 days @ 10 knots speed)

Kedha port (Malaysia): 1494 nm (7 days @ 10 Knots speed)

Above ports are the nearest ports of respective countries from Chennai port. The estimated days are on the higher side to be on safer side. The actual average speed of large shipping vessels is between 13-15 knots, but we have considered worst case scenario to avoid over estimation and keep it as real as possible.

Licence and documents required for exporting foods items:

IEC (import export code)

one need to apply for an Importer Exporter Code (IEC) if you want to import or export anything to and from India to other countries. Technically speaking, IEC is a 10-digit number granted by the Directorate General of Foreign Trade (DGFT) to any Indian entity seeking to do international trade. This code is better known in India simply as an export license, and is easy to apply for and get from the zonal or regional office of DGFT which has jurisdiction over your location of business. You can now also submit an online IEC application at dgft.gov.in with the required documents and fee of Rs. 250.

FSSAI licence for export

One need to obtain an FSSAI License for Export in order to export food outside the country and you need to get the approval for your food product under the health ministry and from FSSAI. This would prove that the item is not harmful and can be consumed by people without causing damage to their health. To obtain the license, an exporter must do the following:

- Get a valid import-export code.

- Register yourself with the Directorate General of Foreign Trade.

- Get a license from the Central Licensing Authority for exporting food items outside the country.

- Make sure that the product being exported has shelf life remaining and is packaged well to reach its destination.

FSSAI NOC

one need to get a NOC before exporting the food items and this is a very important step as it will allow you to further obtain a license from the FSSAI to export your items. Without a NOC, doing further formalities for export of food items will not be possible. You need the following documents to apply for a NOC:

- Country of Origin Certificate

- Importer Exporter Code (IEC) issued by the DGFT

- FSSAI Food Business License

- Bill of Entry

- The end-use declaration, a declaration that food is not GM food

- Besides this, depending on individual import items, other documents may be required.

RCMC (Registration cum membership certificate)

For availing authorization to import/ export or any other benefit or concession under FTP 2015-20, as also to avail the services/ guidance, exporters are required to obtain RCMC granted by the concerned Export Promotion Councils/ FIEO/Commodity Boards/ Authorities.

Labelling Requirements on Food Exports:

When you are exporting the food into foreign markets, you need to make sure that you have enough information and contents listed on the packaging of each food item in order for them to be acceptable in the foreign markets. The labels and content requirements needed for exporting food items are as follows:

- Nutritional facts and information.

- The name of the brand, company, product, etc.

- The product description and the name of the ingredients used in the product.

- The volume of contents and net weight.

-

The Labelling Language should be as per FSSAI (Packaging & Labelling) Regulations, 2011, and the product-specific labelling requirements.

- The “Best Before” date declaration.

- Net weight.

- Declaration of vegetarian and non-vegetarian by symbols.

- The name and address of exporter in India.

- Batch number, code number, lot number, and many more.

Packaging for export:

Packaging used for export will be of three layers.

1st layer: Below is the primary packaging that can be used to actual product in its finished form.

Packaging of sweets:

Tin/Glass – Long shelf life

Retortable PP Cup/tray with top laminate film- light wt, long life, easy peel

Non-retortable Cup/Tray with MAP- Short shelf life

Packaging for chutney powders:

Pillow & Standy pouch – Laminate

Bag in box, Ceka

Packaging for instant mix:

Microvable plastic containers and pouches

High temp resistant cups

Multi-layer cup/tray with peelable laminate

Primary packaging design will be different for different country based on the local packaging information requirements and local people taste and preference. For eg: in Indonesia majority population is Muslim and green is a sacred colour for them, so the primary packaging colour will be green.

2nd layer: Secondary packaging (packing) will be done by placing the primary packaging in the cardboard boxes. Different quantity boxes will be available for different shape and size of products. Every boxes will be labelled with the shipping details like origin country, destination, shipping code, etc.

3rd layer: Tertiary packaging will be done by palletization of the boxes as single unit. All boxes of same category products will be palletized on a single pallet for easy handling of products during transportation. This will standardise the packaging and reduce the efforts and time taken in material handling.

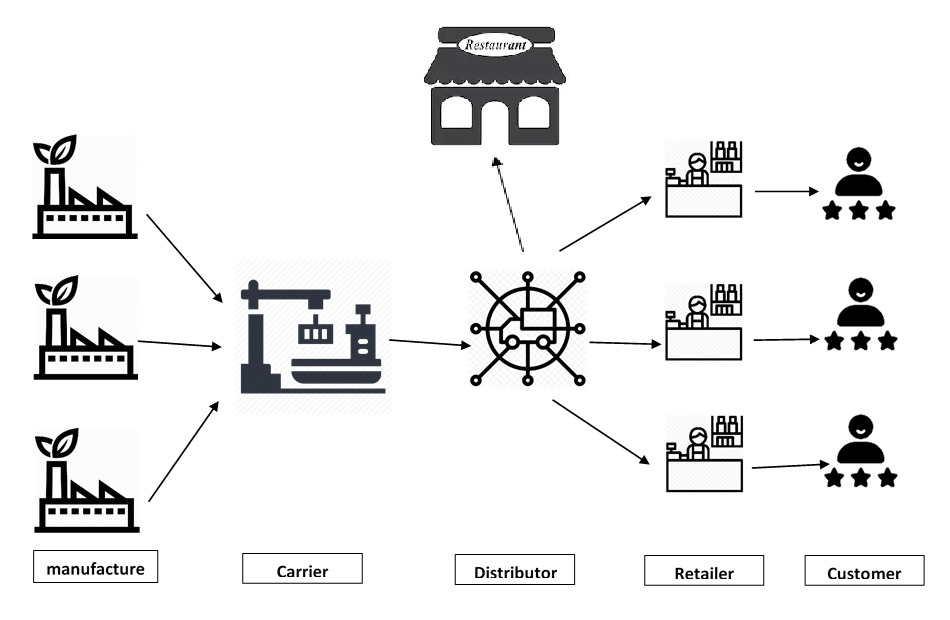

Supply chain for international expansion:

Manufacturer-export agent- shipping (water ways)- Distributors- breaking bulk- retailers/Restaurants - customer

The supply chain is planned to keep as small as possible to have greater margins and quick distribution of products.

The Ramalingam foods is advised to carry out exports with the help of a permanent carrier for regular shipping. The company will export the products to the distributers of different countries from India with the help of clearing agents. The company’s responsibility will be to take orders from the foreign distributers and produce the required quantity. Once the order is confirmed, company will ask its clearing agent to do all the formalities. Company will drop the order in the dockyard and will be responsible for the transport of food items from manufacturing point to the foreign dockyard point. Company will bear all the cost and risk till the order reaches the foreign countries dockyard. Once the ship reaches the dockyard, the ownership of the good will be transferred to the distributer of that country. He will be responsible form there to unload the order, import formalities, transportation thereafter, etc.

Export strategy:

Partnership and alliance: Ramalingam foods is advised to enter the foreign market through partnership and strategic alliance. Partnering with the biggest distributors in respective countries will be the best strategy to enter the foreign market. Since the local distributors have an established logistics and supply chain network and have good market knowledge, it will be helpful for Ramalingam foods. Ramalingam foods doesn’t have to invest in building network, relationship, etc. that will be done by already established partners. Doing so will have following advantages.

- Lower capital required for expansion

- Better market coverage

- Availability of primary market data

- Better understanding of local market

- Accurate Demand & Supply analysis through experience of distributors

- Better control over distribution

- Wide spread market

- Better penetration in remote areas of the country

- Division and reduction of risk

Distributors and wholesalers of target countries to be partner with.

Housen Group ltd. (Singapore)

Hosen Group, or Hock Seng Food as commonly known, was established in the 1970s and has since grown to become one of Asia’s leading importers, exporters and distributors of fast moving consumer goods (“FMCG”), specialising in packaged foods. Hosen Group, through its wholly-owned subsidiaries in Singapore, Malaysia and China, has developed an extensive and robust distribution network that spans Asia, Europe, Middle East, Africa and the Oceanic countries.

Teik Senn (M) Sdn Bhd (Malaysia)

Founded in 1978, Teik Senn (M) Sdn Bhd started as a family business that grew into one of the leading distributors of fast-moving consumer goods (FMCG) in Malaysia. TSM help companies who are looking for a reliable business partner to distribute their product through our extensive distribution channels in Malaysia.

Geeta group distributers (Thailand)

Over the last 20 years, GEETA International Co., Ltd. has transformed a fragmented distribution channel for ethnic consumable food products in Thailand to a mature and customer focused industry. Company’s domestic wholesale distribution, stocks and delivers all supplies needed at South Asian restaurants as well as a full spectrum of offerings available in a typical urban retail supermarket.

Tigaraksa Satria (Indonesia)

Tigaraksa Satria is the largest nationwide distribution company in Indonesia which is fully independent as they do not have their own products. Their nationwide coverage and unique understanding of the local market is what they offer principals and this is their market position.

Pahtama group (Myanmar)

Pahtama Group Co., Ltd. was established in 1997, they are one of the largest and fastest growing distribution companies in FMCG sector in Myanmar. They provide a comprehensive coverage covering Hyper & Super Markets to Small Traditional stores across Myanmar.

Above distributors have the biggest reach across their respective countries and are market leaders there. Ramalingam food are advised to partner with the companies mentioned above for smooth and successful distribution and sales of the products.

Carriers to be selected for India to Southeast Asia.

The rates of ocean freight are not fixed, it can be bargained if the agent we hire have considerable contacts and power. However, there are some carriers that give best services at competitive rates. Following are some carries that can be chosen to partner with for export. Since exporting needs prior booking and depending on availability, company might have to change its carrier. But it is advised that, more or less the service of every company is same so, the decision criteria depends on the lowest rates offered.

- CMA CGM

- COSCO Shipping

- EVERGREEN

- MAERSK

- MSC Cruises

These are the top carriers that carries freight from India to southeast Asia. Here the choice of agent is very important as he can save a lot of cost on booking and cost/container.

Average estimated cost of exporting to Southeast Asia.

Average charges of various companies to export from India to southeast Asian countries lies between 500-1000 INR per container for FCL (Full Container Load). According to this let’s estimate the cost on Higher side to be on safer side.

1000 INR/FCL for 40 feet container, capacity 25 tons.

|

Product |

Country |

Unit (container) |

Price/container (INR) |

Total cost (INR) |

|

North Indian Dishes Instant mix |

Singapore |

1 |

1000 |

1000 |

|

Desert Mix |

Singapore |

0.5 |

1000 |

500 |

|

Chutney powder |

Singapore |

0.5 |

1000 |

500 |

|

South Indian Dishes Instant Mix |

Singapore |

1 |

1000 |

1000 |

|

Local special product |

Singapore |

1 |

1000 |

1000 |

|

North Indian Dishes Instant mix |

Indonesia |

3 |

1000 |

3000 |

|

Desert Mix |

Indonesia |

1 |

1000 |

1000 |

|

Chutney powder |

Indonesia |

1 |

1000 |

1000 |

|

South Indian Dishes Instant Mix |

Indonesia |

3 |

1000 |

3000 |

|

Local special product |

Indonesia |

7 |

1000 |

7000 |

|

North Indian Dishes Instant mix |

Malaysia |

2 |

1000 |

2000 |

|

Desert Mix |

Malaysia |

1 |

1000 |

1000 |

|

Chutney powder |

Malaysia |

1 |

1000 |

1000 |

|

South Indian Dishes Instant Mix |

Malaysia |

2 |

1000 |

2000 |

|

Local special product |

Malaysia |

2 |

1000 |

2000 |

|

North Indian Dishes Instant mix |

Thailand |

1 |

1000 |

1000 |

|

Desert Mix |

Thailand |

0.5 |

1000 |

500 |

|

Chutney powder |

Thailand |

0.5 |

1000 |

500 |

|

South Indian Dishes Instant Mix |

Thailand |

1 |

1000 |

1000 |

|

Local special product |

Thailand |

2 |

1000 |

2000 |

|

North Indian Dishes Instant mix |

Myanmar |

3 |

1000 |

3000 |

|

Desert Mix |

Myanmar |

1 |

1000 |

1000 |

|

Chutney powder |

Myanmar |

1 |

1000 |

1000 |

|

South Indian Dishes Instant Mix |

Myanmar |

3 |

1000 |

3000 |

|

Local special product |

Myanmar |

4 |

1000 |

4000 |

|

TOTAL |

|

44 |

|

44,000 |

Total estimated cost for shipping in all 5 countries is approx. 44,000 Rs. For 44 containers. That is approx. 1100 tons of product is estimated to be exported each month to these countries.

Combined average weight of all variety of products with different variant is 567 grams approx. that is approx. 19,40,000 units exported each month. Means the cost of shipping per product is less than 0.05 rupees.

Above cost estimation is excluding the all other cost like duties, mediators’ charges, commission, etc. if that cost is added, the cost of exporting each product will be not more than 0.4 rupees/unit.

International commercial terms (INCOTERMS) for Ramalingam Foods

To facilitate commerce around the world, the International Chamber of Commerce (ICC) publishes a set of Incoterms, officially known as international commercial terms. Globally recognized, Incoterms prevent confusion in foreign trade contracts by clarifying the obligations of buyers and sellers. Parties involved in domestic and international trade commonly use them as a kind of shorthand to help understand one another and the exact terms of their business arrangements. Some Incoterms apply to any means of transportation; others apply strictly to transportation across water.

List of all INCOTERMS

Four categories can be distinguished:

- E-terms (only EXW): the goods are placed at the disposal of the buyer at the seller’s premises – ‘come to collect the goods’;

- F-terms: the buyer is responsible for the cost and risk of the main international carriage – goods are ‘sent from’;

- C-terms: the seller pays for the main international carriage, but does not bear the risks thereof –goods are ‘sent to, freight prepaid’;

- D-terms: the seller bears all costs and risks up to the delivery point in the country of destination --goods are ‘delivered at’.

Classification of INCOTERMS

|

Departure |

Arrival |

||

|

Category E |

Category F |

Category C |

Category D |

|

EXW |

FCA |

CPT |

DAT |

|

|

FAS |

CIP |

DAP |

|

|

FOB |

CFR |

DDP |

|

|

|

CIF |

|

INCOTERMS best for Ramalingam Foods.

For initial stages since Ramalingam food do not have bargaining power and wants to win the trust of distributor and encourage bulk orders, it is advised to select among ‘C terms.’ However, there are others suggested too for different cases.

To encourage initial trade, company is advised to choose from following terms:

CIF (highly recommendable): under this INCOTERM the Ramalingam foods will be responsible for the cost, insurance and & Freight, but will not be responsible for the risk of delivery. This will be a good incoterm, since now-a-days the risk of transportation is anyways less and buyer will agree to it. Once the order reaches the port of destination then all the risk and expense will be borne by buyer i.e. the cost of unloading, transportation, import duties, etc. This way distributors will be encouraged to buy in bulk orders and reduce the cost on the part of buyer.

CFR (highly recommendable): This is similar to CIF just the difference is, buyer will not provide the distributors with the insurance of the good, the buyer is responsible for insurance and risk from the port of departure onwards.

CIP: Under this incoterm the seller has to pay for carriage and insurance and is responsible for insuring goods for 110% of the value of goods. The risk is to insurance company till the goods reach the port of destination and the buyer is safe from all cost and risk of goods while transit.

FOB: This is extensively used in sea transport, in this term the seller is responsible for the risk and cost only up to the point of loading the good onboard, thereafter the responsibility and cost is borne by distributer. This is recommended to do once the product is in the growth stage and there is increasing demand for the product. That time the distributors will be ready to bare more cost and risk.

FAS: This is recommended to use when your product demand is at peak. In this term the seller bares the rick and cost of only delivering the goods to the port. The responsibility of charges, duties, clearing, etc is borne by buyer/Distributor.

Company can also used among Category D, but this is not recommendable as all the risk and cost under category D is borne by the seller i.e. Ramalingam foods. But in the case where the demand drops, and buyer is not ready to purchase goods, the D category terms can be used.

Conclusion

1. Partnering and strategic alliance with Distributors will make it feasible to enter foreign market though the funds are limited. 2. Packaging used in the exportation of goods are of high quality and standards and will keep the goods safe from damage while exporting. 3. Fishyback technique is used to transport the goods out of India. 4. Manufacturer-export agent- shipping (water ways)- Distributors- breaking bulk- retailers/Restaurants – customer (Supply chain) 5. Shorter supply chain will result in lower distribution cost. 6. Since southeast Asian countries fall in ASEAN association, the cost of exporting in these countries the less. 7. The cost of exporting per product will not be exceeding 0.4 rupees on maximum estimation. 8. The distributors selected in each country are the market leaders and have the biggest retail network. This will reduce the efforts of selling and gain competitive advantages over other brands. 9. The carriers selected are top carriers in southeast Asia. 10. INCOTERS are suggested on the basis of demand analysis. once the bargaining power of Ramalingam foods increases, it can use more of F category terms. 11. Overall export strategy is designed to reduce the cost of exportation and estimates are the rough figures to give Idea of Cost related to exporting.Attached File Details

Shipping process are good , and partnership for export will contribute to reduce cost

Participant

Chinmay Bhavke

MMBGIMS

Currently pursuing MMS in Marketing. I am a analytical and practical thinker, problem solver, specialised in Branding and market research. Runner up of Anveshi (national research conference)

Team Sky BCS 06 Submission

Total Team Points: 63004.5

Team Air BCS 06 Submission

Total Team Points: 66715.5