Announcement

FINAL | BUSINESS CASE - BCS 06

Leader Submission BCS 06

NMO 2020

Comprehensive International Expansion Plan For Ramalingam Foods With Rationale

Submission Date & Time : 2020-04-26 04:23:07

Submitted By: Soumyajit Ghosh - Leader From Team Air

Assignment Taken

Leadership: Develop an International Market expansion plan.Case Understanding

Ramalingam Foods is a successful fast food restaurant, established by Mr. Ramalingam Venkatesh in south Bombay in year 1965, The establishment was famous for their authentic south Indian freshly cooked food and filter coffee. The business grew to become a Pan India Business selling varied products having below products in their portfolio: Instant Dosa Mix, Instant Idli Mix, Instant Gulab Jamun Mix, Instant Laddu Mix, instant coffee powder Instant Dhokla mix. Currently most products are available in 200 Gms, 500 Gms & 1 Kg Packaging. Currently Ramalingam food's operating revenues INR 152 crore for the financial year ending on 31 March 2019. It's EBITDA has increased by 3.16 % over the previous year. At the same time, it's book networth has increased by 20 %. Global Business Consultancy (GBC) is a renowned consultancy firm engaged in helping companies across the world in any business problem. GBC has specialization in business expansions both domestically and internationally. GBC is appointed by Ramalingam Foods as business consultant for international market expansion within a budget of INR 50 Crore for International Business expansion for FY 2019-20. During Initial discussion, it was clear that Ramalingam Foods doesn't have necessary permissions & Licenses for International business. As per current plan they don't have enough capital and business acumen to enter more than one foreign region at a time thus they have requested GBC to suggest one region to start with international expansion. The following parts include a detailed international expansion plan along with all rationale, context and other necessary information.BCS Solution Summary

Global Business Consultancy (GBC) was asked for advise regarding international expansion by Indian Company Ramalingam Foods (Tagline: Making Homemade Chefs Since 1965) which has a ready to cook product portfolio, predominantly South Indian food mix including dosa-idli instant mix powder, dhokla , gulab jamoon mix and filter coffee. GBC has decided the company to expand in Malaysia, Singapore and Indonesia of South-East Asia where there is huge south Indian population. The company would make greenfield expansion in Malaysia followed by export to Singapore (by road) and Indonesia (by waterways) from there. GBC has advised Ramalingam Foods to launch with current products at these three countries in this year with planned product portfolio enhancement over next two years. Ramalingam Foods will focus on R&D for product innovation (both authentic Indian and Indian themed foreign dish), marketing for extending reach cum brand building, world-class IT infrastructure for coping up with digital disruption, employee friendly productive HR policy.Solution

Consulting On International Expansion of Ramalingam Foods by Global Business Consultancy

Mission for International expansion:

In the context of International expansion, Ramalingam Food’s mission would be:

To be the most favourite instant mix and fast-food company overseas while solving problems associated with cooking traditional cuisines and fast foods in a quick and hassle-free way.

Vision for International expansion:

To be the global leader and innovator in ready to eat food markets while giving utmost preference to customer preference, purity and quality.

Tagline: Making Homemade Chefs Since 1965

Objective:

The objectives of Ramalingam Foods in the context of international expansion are given below:

- To establish the brand name across the countries selected for expansion driven by quality, marketing and our employees

- To capture INR 300 CR market in first 3 years of operation or 5% of the market in first year

- To break even in first two years of operation and attain revenue and attain revenue growth of minimum 20% y-o-y

- To add 15% Cr from international business to the company’s bottom-line in 3 years.

- To add at least 6 products (mix of Indian cuisine and international cuisine) on yearly basis driven by R&D

- To enable seamless transition from a domestic company to a global company without hampering fundamental values, principles and maintaining good environment to work

- To target expansion in other countries as well.

Possible Options for Expansion: Entering South East Region with focus on Malaysia, Singapore, Indonesia

Ramalingam Foods management noticed that some people are purchasing their Instant mixes domestically (In India) and selling it in foreign countries through their shops primarily in Middle East, Southeast Asian countries and England. Hence, Ramalingam Foods primarily have the choice of regions Like Middle East Asia, South East Asia, England with the constraint of investment in only one region.

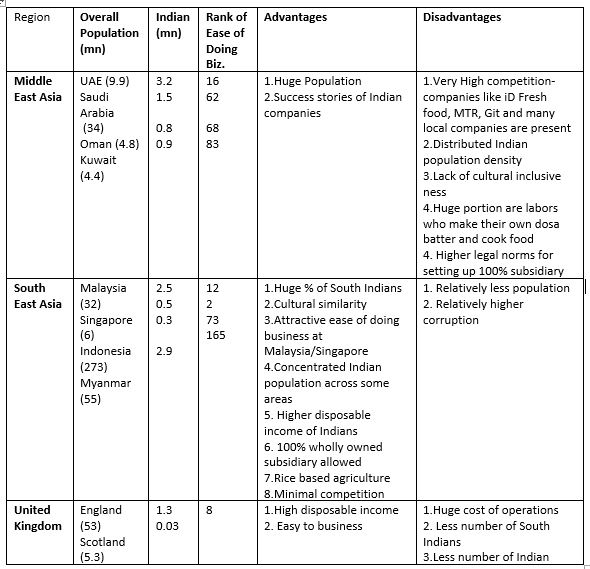

Comparison between three options:

<

On the light of above comparisons, literatures, primary research, GBC has decided to enter the region- South-East Asia with focus on Malaysia, Singapore and Indonesia.

Driving Factors Behind Choosing Malaysia-Singapore-Indonesia:

Similarity in Cuisine:

Due to the influence of people who have settled in South-East Asian countries from India and China during colonisation, the Malaysian indigenous taste and cooking styles of the people are heavily influenced by them. There is a close proximity of borders of all South-East Asian countries, hence their cuisines and tastes are very similar. The country’s Ready-to-eat food market is projected to grow at a CAGR of around 7% during 2014-19. Singaporeans are leading hectic lifestyles and have no time to prepare their meals so they would rather eat on the go or purchase processed and packaged foods.

Concentration of Indian Population:

Indian population concentrated in some areas like Selangor, Johor, Negeri Sembilan, Perak , Penang , Kuala Lumpur,Kedad in Malaysia, Dhoby Ghaut, the Serangoon, Little India areas in Singapore, North Sumatra and urban areas such as Banda Aceh, Surabaya, Medan and Jakarta in India. It’s always easier to operate a business where the target population is concentrated.

Affluence of Tourists:

Malaysia, Indonesia and Singapore being one of the most favorite foreign tourist destinations for Indians- they can take Ramalingam Food’s ready to cook mixes. Also, it might help Ramalingam Food’s B2B business there. In 2018, 5,94,098 Indian tourists visited Malaysia, registering a growth of over 7.5 per cent. In 2018, about 1.44 million Indians visited Singapore (The Business Line, 2019). As many as 5,95,060 Indians had visited Indonesia during 2018 (The Hindu, 2019)

Ease of Doing Business:

Malaysia and Singapore are having very attractive rank in ease of doing business- 12 and 2 respectively (World Bank, 2020). Yet, not many companies focused on Malaysia for developing wholly owned subsidiary and manufacturing set-up. Ramalingam foods should take that advantage.

Higher chance of Vertical Integration:

Since, batter of dosa/idli/vada highly depend on rice production, Ramalingam Food’s long-term goal is to vertically integrate. In this aspect, Malaysia and Indonesia stand in significantly better position. This aspect is detailed later.

High dominance of South Indian Population:

South Indians constitute around 70%, 90% and 60% of Indian Population in Malaysia, Singapore and Indonesia respectively. Since Ramalingam Food’s USP is batter of dosa/idli, it would be easier to get target market.

Less Competition:

Where ready to make food companies like iD fresh, Git, MTR have already focused on Middle -East, the similar focus has not been given to South-East nations which makes the competition much less in that area.

Why Malaysia First?

Against the backdrop of a challenging external environment and declining global FDI inflows, Malaysia remains resilient and attracted a total of RM207.9 billion of approved investments in the manufacturing, services and primary sectors in 2019, a 1.7 per cent increase, compared to 2018. Malaysia’s manufacturing sector recorded approved investments of RM82.7 billion for 2019. The number of manufacturing projects approved increased by 37 per cent from 721 projects in 2018 to 988 projects in 2019. FDI accounted for 65.2 per cent (RM53.9 billion) of total approved investments in the manufacturing sector, while domestic investments constituted the remaining 34.8 per cent (RM28.8 billion).

The major driving force behind selecting Malaysia are:

- Huge Indian population (around 2 million- 7.3% of Malaysia’s population)

- Among Indian, the dominant people belong to Tamil, Malayali, Telugu who have natural liking towards Idli, Dosa etc. which are RF’s main products. It is safer to venture in a location where proven target customers exist.

- Many cultural similarities between Indian and Malaysian population

The rationale for investment in Malaysia is given by PESTLE Analysis and other factors as described below:

PESTLE Analysis:

PESTLE analysis a mnemonic which in its expanded form denotes P for Political, E for Economic, S for Social, T for Technological, L for Legal and E for Environmental. It’s an important concept is used as a tool by companies to track the environment they’re operating or planning to launch a new project/product/service etc.

Political:

Malaysia is made up of thirteen states, three federal territories, and a monarchy. Here, the elected Prime Minister handles most of the country’s policies and regulations- hence seeking clearance, permissions etc. for Ramalingam Foods will be in a centralized way. Malaysia is a member of the Commonwealth of Nations, the UN, ASEAN, OIC. Being member of international organisations will make the country cosmopolitan and a junction for country tie-ups. It pursues the principles of peace and neutrality in developing and implementing its foreign policies. The only concern is corruption.

As per data provided by the World Bank, Political stability index for Malaysia from 2014 to 2019 has been around 0.25 where (-2.5 indicates weak and 2.5 indicates strong. (TheGlobalEconomy, 2019).Which indicates that Malaysia’s political stability is medium and improving for last five years..

Economic:

The World Bank Doing Business 2020 Report has ranked Malaysia in 12th position amongst 190 economies worldwide (Thestar, 2019). Malaysia's economy grew by 3.6 percent year-on-year in the fourth quarter of 2019 (Trading Economics, 2020). Malaysia has a healthy, robust, and industrialised economy. As of August 2019, the unemployment rate in the country is 3.3%. Malaysian economy is diversified and very robust with focus on industrialised, and knowledge-based industries. The economy has benefitted from the adoption of cutting-edge technology. According to IMF (2018) Malaysia is well on its way to achieving high-income status. Global rank of Malaysia as per GDP per Capita is 49 with the value of 34567$ (IMF, 2020), about 17 times as compared to India. Inflation rate is under control around 2.1%

From these data, we can tell that economic condition of Malaysia is fair although there are concerns due to recent drop in crude oil price. Being from India, Ramalingam can leverage the improvement in economic condition in Malaysia as compared to India.

Social:

Malaysia is a multi-ethnic, multi-religious country where Hinduism, Sikhism are well prevalent along with Tamil, Telugu, and Malayalam speaking people. The communal harmony is a great feature of the country.

Malaysia has a rich cultural life where people lead a much more affluent lifestyle compared to their counterparts in many upper-middle income countries. The major factors contributing to this affluent lifestyle are low national income tax, almost free health care system, social welfare system, and a low cost of local food, fuel, and household products.

But, the government limits freedom of speech by directly and indirectly controlling almost all the media. The family is considered the centre of the social structure.

Having a huge Indian population (predominantly South Indian), Ramalingam can find enough similarities between its target segments in both the countries.

Technological:

Malaysia is one of most digitally connected societies in the world. Approximately, 80% of its residents have access to the Internet, mostly through mobile networks. Malaysia has been a great place for international tech companies due to its strategic location, tech savvy work force, and IT infrastructure. According to Malaysia’s Department of Statistics, the digital economy contributed 18.3% to the nation’s GDP in 2017 and is slated to reach a stretched target of 20% by 2020. (Avantikumar, 2019). The technologically-inclined economy of Malaysia is proven through the country's involvement in advanced electronics manufacturing, R&D, biotechnology, photonics, logistics, design, innovation and a highly automated manufacturing sector, to name a few. There have been technological advancements taking place in the fields of manufacturing, agriculture too.

Since Ramalingam Foods has mostly automated factories in India, it would be benefitted to set up similar factory in Malaysia and would leverage ecommerce growth and digital reach in their sales and marketing.

Legal:

Malaysia follows the common law system. The country follows a legal framework which involves the protection of Malaysian citizen rights, but also follow state laws in specific areas. In World Bank’s Doing Business Report 2017, Malaysia ranked 3rd in protecting minority investors. Greater Kuala Lumpur is also home to the Kuala Lumpur Regional Centre for Arbitration which provides settlement for trade, commerce, and investment disputes within the region. There are not any such laws that deter investment in Malaysia. The only bit concern is the corruption in Govt. and lack of enough intervention of Police in the same.

Environmental:

Malaysia has a wide range of flora and fauna with 50-70% of the country being made up of tropical rainforests. Due to high exports of palm oil and mining, there have been mass deforestation, forest conversion, river pollution and land reformation leading to change of ecological landscape. So, this nation is not so good from environmental angle. But there are new government laws to control damages to the nature regarding waste disposal, emission from factories etc. and the situation might improve.

From PESTLE analysis, Malaysia is one of the most attractive destinations for international expansion.

Other Driving Factors for Malaysia:

Free Trade Agreement:

- The Malaysia-India Comprehensive Economic Cooperation Agreement (2011) is a comprehensive agreement that covers trade in goods, trade in services, investments and movement of natural persons.

- It value-adds to the benefits shared from ASEAN-India Trade in Goods Agreement (AITIG) and will further facilitate and enhance two-way trade, services, investment and economic relations in general.

Tax Incentives:

Specific incentives are introduced to attract investment into food projects both at the farm level as well as at the production/processing level. These will enhance the supply of the raw material for the food processing sector and thus reducing reliance on imports of such raw material.

Tax incentives are given to companies engaged with project of approved food production. The tax incentives given are as follows:

- A company which invests in its subsidiary company engaged in food production activities can be considered for tax deduction equivalent to the amount of investment made in that subsidiary for that year of assessment; and

- The subsidiary company undertaking food production activities can be considered for a full tax exemption on its statutory income for ten years of assessment for new project or five years of assessment for expansion project.

Supportive Government Policies

- Pro-business, Liberal investment policies

- Responsive government

- Liberal exchange control regime

- Intellectual property protection

An Educated Workforce

- Talented, young, educated and productive workforce

- Multilingual workforce speaking two or three languages, including English

- Comprehensive system of vocational and industrial training

- Harmonious industrial relations with minimal trade disputes

Developed Infrastructure

- Network of well-maintained highways and railways

- Well-equipped seaports and airports

- High quality telecommunications network and services

- Fully developed industrial parks, including free industrial zones, technology parks and Multimedia Super Corridor (MSC)

- Advanced MSC Malaysia Cybercities and Cybercentres

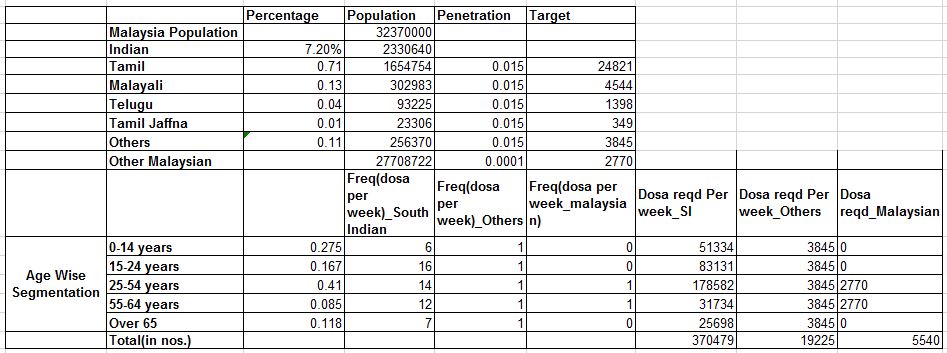

Target Customer:

Since Ramalingam Foods has expertise and intensive R&D in Indian cuisines, especially South-Indian cuisines, mainly Indian population is targeted in the first phase. It is favorable for Ramalingam Foods too as the Indian population is dominated by Tamils and Malayali community.

Along with this, some Malaysian Instant Food-mix to gain prominence among Malaysian population and subsequently other Indo-Singaporean and Indo-Indonesian food mixes will be launched to target non-Indian population..

- In Indian segment, our target customers would be all people of Selangor, Perak, Johor, Kuala Lumpur, Penang and Nageri Sembilan in Malaysia.

- Given that, the decision makers will be people in the age group of 20-60 years with RM 3000 and higher monthly income level.

- The persona of our target customers or decision makers would be: Both male or female, Age 20-60, College goers, office goers and businessmen

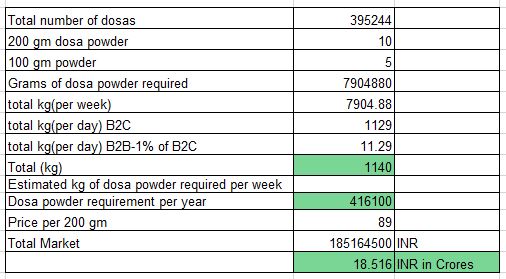

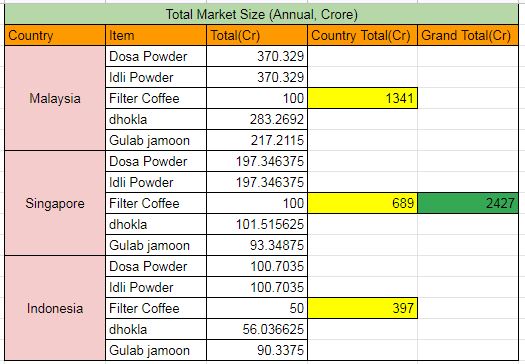

Market Size Estimation:

We estimated sample size of the whole market(from consumption side) , which is a good market size for Ramalingam foods to entry

Strategic Decisions:

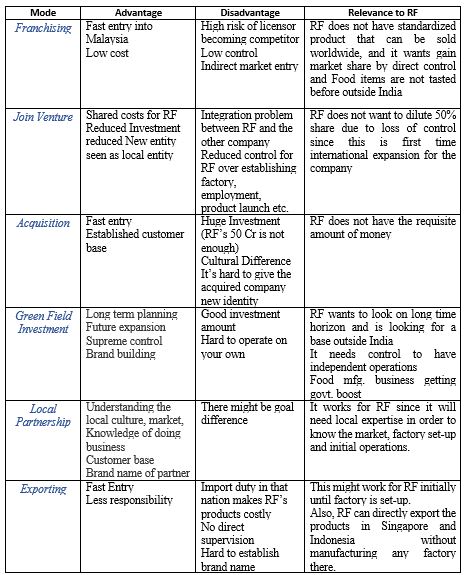

1. Mode of entry:

Greenfield Expansion for Malaysia and Direct Exporting to Singapore and Indonesia

Next, regarding the market entry strategies, the viability, pros and cons for each mode of market entry strategies are analyzed below. Along with that the relevance for Ramalingam Foods has been discussed to come-up with the ideal market entry strategy.

Since RF wants to be the global leader in ready to eat food segment without losing control over operations, RF is advised to enter Malaysian market with greenfield expansion where it will have it’s own manufacturing setup and without change of name, products and operations. Since June 2003, foreign investors could hold 100% of the equity in all investments in new projects, as well as investments in expansion/diversification projects by existing companies, irrespective of the level of exports and without excluding any product or activity

Since GBC would help RF with all necessary market research, consumer behavior, product strategy, distribution insights etc., Rf will not face the traditional difficulties those are faced by a company while expanding into a new territory due to lack of local knowledge and expertise.

On the other hand, Ramalingam Foods will expand into Singapore and Indonesia through direct exports. It will save manpower expenses, manufacturing cost due to economies of scale. At the same time, it will have the opportunity to withdraw from the market if in any case it’s products does not do well.

|

Country |

Property |

|

Malaysia |

One manufacturing set-up with office (leased) |

|

Singapore |

One lean regional office(rented) |

|

Indonesia |

One lean regional office(rented) |

Ramalingam Foods will start exporting to Malaysia, Singapore and Indonesia from India itself and will divert the export from Malaysia to other two countries once the factory is set-up.

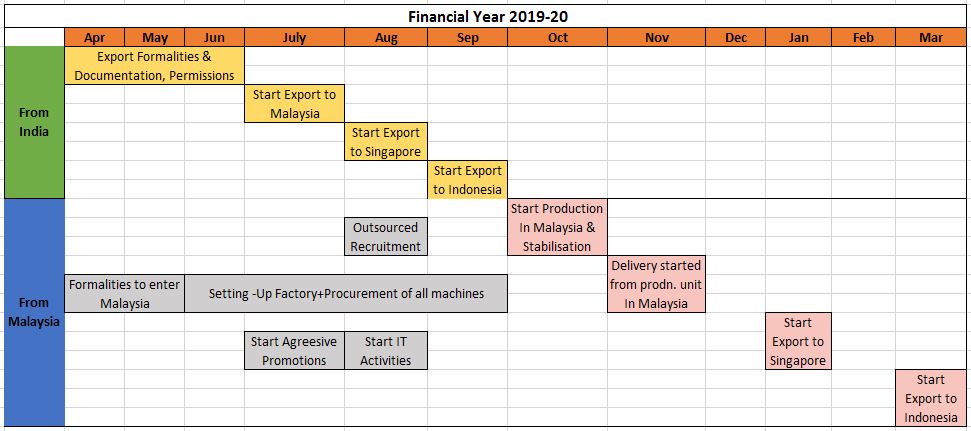

1.Timeline of Expansion

- Starting export to Malaysia, Singapore and Indonesia from July’19 (in consecutive months to allow stabilization) after 3 months of legal formalities and permissions

- Apr-Sep’19 is assigned for legalities and factory setup at Malaysia where production will start in Oct’19

- There will be diversion of export from Malaysia (instead of India) to Sinagpore and Indonesia in Jan’20 and Mar’20 respectively.

- The interim times will be spent in value added activities.

Way of Export

Singapore is around 600km away from Kuala Lumpur, Malaysia and hence it is easier to export by roadway.

The length of shipping route between Port of Klang, Malaysia and Port of Samarinda, Indonesia is 2666 km and the exports will be by shipping.

1.Whether to export or manufacture?

The products will be manufactured in Malaysia with primary import of raw materials from India. But since rice is one of the main food grains of Malaysia and there are immense paddy fields in Malaysia and Indonesia, there are opportunities of importing partial raw materials from these two countries.

For achieving economies of scale, the whole production will be centered at Malaysia and food items will be exported to Singapore and Indonesia.

2.Where to set-up factory?

The factory will be set up at Johor (Malaysia) due to the following reasons:

- Close proximity to Sea port that will kelp in exporting to Indonesia

- Closer to Singapore

- High density of Indian population

- Low cost of industrial area (RM 1.2-3 per sq.ft)

- Well connectivity with other parts of the country

3.Product Strategy

Ramalingam Foods will primarily focus to build on it’s existing portfolio of products since those are well taken, proved products. Venturing into too many products altogether would not be good. Ramalingam foods would increase it’s portfolio in a phased manner with inclusion of other related products like Vada, Uttapam (South Indian), Poha, Pulao etc. (North Indian), Rasmalai, Boondi etc. (Desert) etc.

Along with it , Ramalingam Foods will launch foods that suits the non-Indians too. These will be foreign dish with Indian fusion.

4.Food R&D:

Ramalingam Foods will invest INR 5 CR as of now for intensive R&D in food for new product and packaging innovation

5.Outsourced activities

Only recruitment for overseas and logistics handling have been outsourced since Ramalingam has not expertise in these .

6.B2B sales or B2C sales?

Ramalingam Foods will do both B2B and B2C sales. While retail customers will be the main target, as per research, the B2B business might be upto 5% of B2C business.

Due to huge tourists, many of the restaurants sell Indian cuisine including South Indian Food, North Indian Food, Desert and hence we expect to gather good sales through them.

7.How to do marketing?

One of the aims of RF is brand building asap since brands play major role in food market as a hallmark of purity and quality. For building that, RF needs to keep marketing under its own control and invest good amount behind promotional exercises. Main mediums of promotion:

- Digital Marketing (SEO, Social Media)

- Leaflet distribution in areas with Indian Population

- Promotion for incoming tourists

- Advertisement at prominent places i.e parks, malls, markets etc. to get visibility

The detailed marketing plan will be available with the report focused on Marketing.

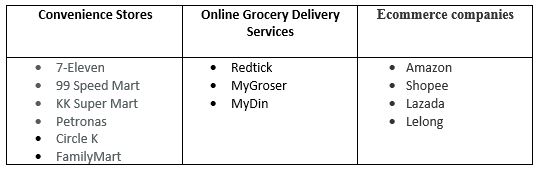

8.Distribution channel

Both offline and online. Since a huge portion of our target segment buys from convenience stores as well as ecommerce sites due to rapid increase of internet penetration, it is prudent to sell through both online and offline channels.

9.Strategic Investment in Tech Start-up:

In today’s world, foreseeing is one of the most important driving factors behind success of any company. GBC advises Ramalingam Foods to invest in some technologies for future benefits. Since it is hard for Ramalingam Foods to develop that expertise in short span, it would be prudent to invest in start-ups those are potential and work on some topics which are in line with Ramalingam Food’s work.

One such area is Blockchain(very effective in cross border trade finance) and another being is Virtual and Augmented Reality(for customer experience enhancement).

Ramalingam Food is advised to invest INR 50 lac each in two startups., namely WoToken in Blockchain domain and RevoAR in Virtual and Augmented reality.

10.Vertical Integration

Ramalingam Foods is eyeing long term growth which can be backed up by reducing dependence. Since rice grain is the main raw material for production, hence it would want to vertically integrate by buying paddy fields.

In Malaysia, paddy contributed 2.3% of GDP in 2016 and the nation produced a total of 2.7m MT of paddy. Out of this, 2.0m MT or 74.1% of the total paddy produced was from the granary areas. On the other hand, providing around 50% of Indonesians’ daily caloric needs, rice remains by far the most important staple crop across the country. As of 2018, Indonesia produced in excess of 56.5 million tonnes of husked rice. This is projected to increase to reach 60.8 million tonnes of husked rice by 2020, with Java’s three main rice-producing provinces (East, West, and Central Java) still playing a crucial role in rice production.

Hence, Ramalingam Foods will be allocating an amount of 10 Cr for acquiring paddy fields in Malaysia and Indonesia for vertical integration

11.Future Expansion

Ramalingam Foods can enter into other countries in the same region after half an year operation in these 3 countries. This time span is for stability and correction of mistakes if any.Thailand can be entered. The other opportunity lies in Middle east although the competition is high. Nevertheless, if Ramalingam Foods can attain the brand name in South-East asia, it can leverage that for other expansion.

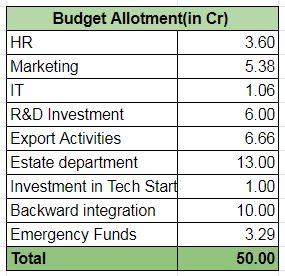

Financial:

The utilization INR 50 Cr investment is shown below:

Management Principles:

- Employee friendly organization

- Medium level aggression

- Controlling risk

- Value transfer to the customer

- Investment for long term horizon

- Invest in manpower

- Honesty, loyalty and hardworking for success

- Departmental coordination

- Entrepreneurial spirit

- Quest for learning

Conclusion

Global Business Consultancy will help Ramalingam Foods in passing through all legal aspects with necessary documentation and certificates. Also, Ramalingam Foods have to formulate and abide by some policies or practices to cope up with change management occurring due to international expansion.Attached File Details

Participant

Soumyajit Ghosh

IIM Bangalore

Entrepreneurial by the mindset and hard-working by nature, Soumyajit Ghosh believes himself to be an energetic, enthusiastic, and honest person who completed his MBA from IIM Bangalore in 2020.At IIM Bangalore, he won several case competitions (Campus as well as National level) like Flipkart Wired National Winner, ITC Interrobang Campus Winner, etc. to name a few. He has also been nominated as one of Top 100 Competitive Business Leaders of the country in 2019-20 by Dare2Compete.Prior to IIMB, he has rich work experience of 47 months at GAIL(India) Ltd as Senior Engineer (Operations). Soumyajit earned a B.E. in Chemical Engineering from Jadavpur University (Rank 3rd) in 2014. Soumyajit also enjoys graphology, equity trading etc. and has honed his interest by certifying himself as Equity Research Analyst from NISM and Technical Analyst from FLIP.

Team Sky BCS 06 Submission

Total Team Points: 63004.5

Team Air BCS 06 Submission

Total Team Points: 66715.5

Sapthagiri college of engineering

Sapthagiri college of engineering